Snx File

Synnex spun off Concentrix effective December 1, 2020 in a transaction meant to be tax-free to Synnex shareholders. Concentrix began normal trading on December 1, 2020.

This action is a standard spinoff transaction in the accounting software. It is structured to be a non-taxable event for Synnex shareholders. The cost basis allocation information is calculated from the average of the opening and closing prices of CNXC and SNX on the effective date of the spinoff. Neither company has posted guidance on their websites on cost allocation at the time these instructions were written.

- SNX sells the best production woodworking machinery solutions - for any shop, any size. We source the globe to provide maximum innovation, durability and high-performance technology offered direct from the factory for a better value every time.

- SNX acts as collateral; staking a proportional value of SNX is required to mint Synths. Stakers are rewarded for supporting the system with a pro-rata share of the fees generated by activity in the system. The value of SNX is thus directly connected with the usage of the network it collateralizes.

- SNX file is a ZX Spectrum Emulator Snapshot Extended. It is an extended version of SNA. The ZX Spectrum is a home computer (8bit) released in the United Kingdom in 1982 by Sinclair Research Ltd.

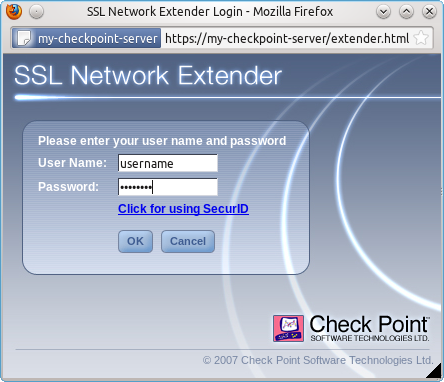

Sudo ldd /usr/bin/snx This should list a library file for each line and should not report any missing libraries. Some Notes on the Mechanisms. This section discusses some of the internals of how the snx program is called by the Java framework and snxconnect.

NOTE:

The cost basis allocation is dependent on the prices used for both Synnex and Concentrix in the cost basis allocation calculations. In our experience brokers tend to use the prices found in the guidance companies post on their websites including IRS form 8937. If your broker does not use that guidance, the cost basis of the companies involved as recorded in your accounting records and in your broker’s records will not match. This is not cause for concern. This is just due to the inexact nature of the tax code in this regard. Partnership tax returns have specific areas to reconcile these usually small differences. ICLUBcentral tax printer software automatically fills in these adjustments in the normal operation of the software using the data imported from your accounting records and that you enter from your 1099.

The Spinoff Entry

Snx File Opener

Go to Transactions > Spinoff or Accounting > Securities > Record spinoff of securities depending on the version of the software being used. If you are unfamiliar with spinoff transactions you can get help at this URL: http://www.iclub.com/support/kb/default.asp?page=normal_spinoff

Here is the information you need to complete the spinoff.

- Date: 12/1/2020

- Select Parent Security (or Parent Company) : Synnex (SNX)

- Remaining Basis Percentage: 46.07

- Cash received: See your broker statement for cash-in-lieu received

- Spinoff Security (or Symbol of New Company) : Concentrix (CNXC)

- Shares received : 1.0 x (# of SNX shares owned) (Remember to include fractional shares.)

- For example, if you owned 100 SNX shares, you should receive 1.0 x 100 = 100 CNXC shares.

- Price Per Share : 92.5 (Average of open and close prices on 12/1/2020)

Save the transaction and the spinoff has been entered.

Synnex spun off Concentrix effective December 1, 2020 in a transaction meant to be tax-free to Synnex shareholders. Concentrix began normal trading on December 1, 2020.

This action is a standard spinoff transaction in the accounting software. It is structured to be a non-taxable event for Synnex shareholders. The cost basis allocation information is calculated from the average of the opening and closing prices of CNXC and SNX on the effective date of the spinoff. Neither company has posted guidance on their websites on cost allocation at the time these instructions were written.

NOTE:

Snx Log File

The cost basis allocation is dependent on the prices used for both Synnex and Concentrix in the cost basis allocation calculations. In our experience brokers tend to use the prices found in the guidance companies post on their websites including IRS form 8937. If your broker does not use that guidance, the cost basis of the companies involved as recorded in your accounting records and in your broker’s records will not match. This is not cause for concern. This is just due to the inexact nature of the tax code in this regard. Partnership tax returns have specific areas to reconcile these usually small differences. ICLUBcentral tax printer software automatically fills in these adjustments in the normal operation of the software using the data imported from your accounting records and that you enter from your 1099.

The Spinoff Entry

Go to Transactions > Spinoff or Accounting > Securities > Record spinoff of securities depending on the version of the software being used. If you are unfamiliar with spinoff transactions you can get help at this URL: http://www.iclub.com/support/kb/default.asp?page=normal_spinoff

Here is the information you need to complete the spinoff.

- Date: 12/1/2020

- Select Parent Security (or Parent Company) : Synnex (SNX)

- Remaining Basis Percentage: 46.07

- Cash received: See your broker statement for cash-in-lieu received

- Spinoff Security (or Symbol of New Company) : Concentrix (CNXC)

- Shares received : 1.0 x (# of SNX shares owned) (Remember to include fractional shares.)

- For example, if you owned 100 SNX shares, you should receive 1.0 x 100 = 100 CNXC shares.

- Price Per Share : 92.5 (Average of open and close prices on 12/1/2020)

Snx File

Convert Snx Files To Avi

Save the transaction and the spinoff has been entered.